Commonwealth of Australia Explanatory Memoranda

Commonwealth of Australia Explanatory Memoranda Commonwealth of Australia Explanatory Memoranda

Commonwealth of Australia Explanatory Memoranda[Index] [Search] [Download] [Bill] [Help]

2002-2003-2004

THE PARLIAMENT OF THE COMMONWEALTH OF AUSTRALIA

SENATE

SUPERANNUATION LEGISLATION AMENDMENT (CHOICE OF SUPERANNUATION FUNDS) BILL 2003

REVISED EXPLANATORY MEMORANDUM

(Circulated by authority of the

Treasurer, the Hon Peter

Costello, MP)

THIS MEMORANDUM TAKES ACCOUNT OF AMENDMENTS MADE BY THE HOUSE OF REPRESENTATIVES TO THE BILL AS INTRODUCED

Table of contents

The following abbreviations and acronyms are used throughout this revised explanatory memorandum.

|

Abbreviation

|

Definition

|

|

APRA

|

Australian Prudential Regulation Authority

|

|

ASIC

|

Australian Securities and Investment Commission

|

|

ATO

|

Australian Taxation Office

|

|

AWA

|

Australian Workplace Agreement

|

|

Commissioner

|

Commissioner of Taxation

|

|

CPI

|

consumer price index

|

|

CSS

|

Commonwealth Superannuation Scheme

|

|

PDS

|

Product Disclosure Statement

|

|

PSS

|

Public Sector Superannuation Scheme

|

|

RSA

|

retirement savings account

|

|

RSA Act

|

Retirement Savings Accounts Act 1997

|

|

SG

|

superannuation guarantee

|

|

SGAA 1992

|

Superannuation Guarantee (Administration) Act 1992

|

|

SGC

|

superannuation guarantee charge

|

General outline and financial impact

Schedule 1 to this bill amends the SGAA 1992 to:

• require employers to make superannuation contributions on behalf of an employee to a complying superannuation fund, superannuation scheme or RSA in compliance with the choice of fund requirements; and

• provide for penalties for breach of the choice of fund requirements.

Date of effect: The amendments will apply from 1 July 2005. To avoid having to pay any penalty, employers will be required to provide superannuation support in compliance with the choice of fund requirements from this date on.

Proposal announced: This proposal was first announced in the 1997-1998 Federal Budget. Previous legislation to implement the proposal was defeated in the Senate on 8 August 2001. Details of the measure were given in Minister for Revenue and Assistant Treasurer’s Press Release No. C42/02 of 14 May 2002. Revised details of the measure were announced in Minister for Revenue and Assistant Treasurer’s Press Releases No. C40/03 of 25 May 2003 and No. C94/03 of 9 October 2003.

Financial impact: This measure will involve expenditure of $28 million over four years. This is being fully absorbed within the existing resourcing of the ATO. This bill allows choice to be extended to CSS and PSS members. The financial impact of allowing choice to be offered to these members will be outlined in the explanatory memorandum for other legislation necessary to facilitate that compliance.

Compliance cost impact: The compliance cost impact for groups affected by the measure is set out in the following table:

|

Impact group

|

Initial costs

|

Recurrent costs

|

|

Employers

|

$27 million

|

$18 million

|

|

Employees

|

n/a*

|

n/a*

|

|

Fund/RSA providers

|

$7 million

|

$2 million

|

* The costs for employees are unquantifiable.

Impact: Providing choice of fund will increase costs to some employers. The Government believes the benefits of choice to employees and the community more generally, outweigh these costs.

Main points: Employers will:

• need to familiarise themselves with the change;

• have to make contributions to a greater number of funds and RSAs than at present; and

have additional record keeping requirements in keeping track of employee choices.

Chapter

1

Choice

of superannuation funds

1.1 This chapter outlines the amendments to the SGAA 1992 to:

• require employers to make compulsory superannuation contributions to a complying superannuation fund, superannuation scheme or RSA in compliance with the choice of fund requirements; and

• impose penalties on employers who fail to satisfy their choice of fund obligations.

1.2 On 5 November 2001 the Government reaffirmed, as part of the policy document A Better Superannuation System, its commitment to providing workers the freedom to decide who manages their superannuation.

1.3 The choice of fund amendments will increase competition and efficiency in the superannuation industry, leading to improved returns on superannuation savings and placing downward pressure on fund administration charges.

1.4 Item 22 inserts Part 3A into the SGAA 1992 which sets out the choice of fund requirements. Essentially, an employer will meet these requirements where they provide superannuation support or make contributions to a fund chosen by the employee in accordance with the provisions. Where an employee does not choose a fund, the employer will comply with the choice of fund requirements by contributing to any eligible choice fund. An eligible choice fund is a complying superannuation fund or RSA. Employers who are required to make award payments to a fund nominated in a Commonwealth industrial award will continue to make payments to that fund.

1.5 Part 3A provides the process to be followed where an employer is required to offer choice of fund to employees. Specifically Division 6 provides for when and how this is done.

1.6 Division 4 provides the process to be followed when an employee is choosing a fund as well as the types of funds which may be chosen.

1.7 This bill also sets out the other circumstances where superannuation contributions are made in compliance with the choice of fund requirements, for example, contributions made in accordance with a workplace agreement [Schedule 1, item 22, subsection 32C(6)], as well as prescribes a class of employee who cannot choose the fund into which their superannuation contributions are paid.

1.8 Where an employer fails to satisfy their choice of fund obligations a taxation penalty may apply.

1.9 This bill also amends the RSA Act to ensure that choice of fund operates as intended. [Schedule 1, item 1A]

1.10 Part 3A makes frequent reference to a fund. A fund is defined for these purposes to mean a superannuation fund, a superannuation scheme and an RSA [Schedule 1, item 22, section 32E]. The term ‘contribution to a fund’ used in section 32C also includes notional contributions to a defined benefit scheme (see paragraph 19(2B)(b) and the note at the end of section 32C). A holder of an RSA is taken to be a member [Schedule 1, item 22, subsection 32E(2)] since the RSA 1997 refers to the term RSA holders, not members of an RSA. References to the regulations is a reference to the Superannuation Guarantee (Administration) Regulations 1993.

|

New law

|

Current law

|

|---|---|

|

Employers must provide their employees with a choice of superannuation fund

to which the employer will make the employee’s superannuation

contributions.

|

There are no equivalent provisions in the SGAA 1992. Currently, employers

may choose the fund to which they pay their employee’s superannuation

contributions unless determined by an award.

|

1.11 The detailed explanation of the new law is divided into five parts:

• Part 1 outlines which contributions will satisfy the choice of fund requirements;

• Part 2 outlines how an employee can choose a superannuation fund, an employee’s obligations and the type of funds that can be chosen;

• Part 3 outlines the obligations on employers when offering choice including the role of the standard choice form;

• Part 4 deals with other matters resulting from the choice of fund requirements; and

• Part 5 deals with penalties for a contravention of the choice of fund requirements.

1.12 Contributions made by employers for the benefit of employees must be in accordance with the choice of fund requirements. [Schedule 1, item 22, section 32C]

1.13 It should be noted that while section 32C refers to ‘contributions made’, it also covers support provided through defined benefit schemes, including unfunded ones. This is because paragraph 19(2B)(b), which deals with defined benefit schemes, refers to notional contributions to the scheme (see paragraph 1.10). It is these notional contributions, as well as actual contributions to superannuation funds, that are referred to in section 32C (see note at end of section 32C).

1.14 The following contributions are made in compliance with the choice of fund requirements:

• contributions to a chosen fund [Schedule 1, item 22, paragraph 32C(1)(a)];

• contributions to an eligible choice fund, where an employee has not chosen a fund provided that where required to do so, the employer has provided the employee with a standard choice form [Schedule 1, item 22, subsections 32C(2) and (2A)];

• contributions to unfunded public arrangements other than contributions in respect of Commonwealth employees that are members of the CSS or the PSS [Schedule 1, item 6, definition of ‘Commonwealth employee’ in subsection 6(1); item 8, definition of ‘CSS’ in subsection 6(1); item 12, definition of ‘PSS’ in subsection 6(1); and item 22, paragraph 32C(1)(b)];

• contributions made to the CSS, PSS and contributions made under the Superannuation (Productivity Benefit) Act 1988 until such time as regulations are made such that these subsections do not apply [Schedule 1, item 22, subsections 32C(3) to (5)];

• contributions made under, or in accordance with, an AWA or a certified agreement under the Workplace Relations Act 1996, or a certified agreement under the Industrial Relations Act 1988 or made under certain Victorian agreements [Schedule 1, item 22, subsections 32C(6) and (7)];

• contributions made in respect of an employee where the contribution is made under or in accordance with, a ‘State industrial award’ [Schedule 1, item 13, definition of ‘State industrial award’ in subsection 6(1); and item 22, subsection 32C(8)]; or

• contributions made under prescribed laws [Schedule 1, item 22, subsection 32C(9)].

1.15 Part 4 of this document elaborates on these arrangements.

1.16 This bill sets out the circumstances in which:

• a fund becomes a chosen fund;

• an employer does not have to accept an employee’s choice; and

• a fund ceases to be a chosen fund.

1.17 This bill also prescribes the types of funds which may be chosen.

1.18 An employee must give their employer written notice to the effect that they want a fund to be a chosen fund [Schedule 1, item 22, subsection 32F(1)]. The fund becomes a chosen fund two months after the employee has given the notice to the employer or an earlier time determined by the employer [Schedule 1, item 22, subsection 32F(2)].

1.19 Employers do not have to accept a choice if the employee is unable to provide certain information such as the name of the fund and evidence that the chosen fund will accept the contributions from the employer on behalf of the employee. This could be evidence of an account number [Schedule 1, item 22, subsection 32FA(1)]. An employer may also refuse to accept an employee’s chosen fund if the employee has already chosen a fund within the previous 12 months [Schedule 1, item 22, subsection 32FA(2)].

1.20 Section 32H outlines the circumstances in which a fund will cease to be a chosen fund. These are:

• the employee chooses another fund as a chosen fund and the employee has not given the employer written notice stating that the old fund continues to be a chosen fund;

• if the employee requests the employer to give them a standard choice form, and the employer does not do so by the specified time;

• the employer can no longer contribute to a chosen fund; or

• a fund ceases to be a chosen fund if the fund ceases to be an eligible choice fund for the employer (see paragraph 1.22).

1.21 A fund can only be a chosen fund if it is an eligible choice fund and it will accept contributions from the employer on behalf of the employee at the time that the choice is made. [Schedule 1, item 22, section 32G]

1.22 A fund is an eligible choice fund at a particular time if:

• it is a complying superannuation fund at that time;

• it is a complying superannuation scheme at that time;

• it is an RSA;

• at that time a benefit certificate is conclusively presumed under section 24 of the SGAA 1992 to be a certificate in relation to a complying superannuation scheme; or

• contributions made by the employer to the fund at that time are conclusively presumed under section 25 of the SGAA 1992 to be contributions to a complying superannuation scheme.

[Schedule 1, item 22, section 32D]

1.23 This bill prescribes a class of employee who cannot choose a fund into which their superannuation contributions are paid [Schedule 1, item 22, subsection 32F(3)]. This will ensure that employers are not required to fund additional superannuation benefits for employees.

1.24 The trust deeds of some defined benefit schemes require a full retirement, retrenchment or resignation benefit to be paid to a person provided they are a member of the fund on these events. These benefits would not be reduced even though the employer is required to make contributions to another fund under the choice of fund requirements. Generally, a person can remain a member of these schemes provided they are still employed with the company, that is, an employer cannot force an employee to leave the scheme.

1.25 Subsection 32F(3) ensures that employees who remain members of these defined benefit schemes cannot choose another fund. This will ensure that an employer in this situation will not have to make contributions to the fund chosen by the employee while also being required to finance that employee’s rights to receive a full retirement, retrenchment or resignation benefit in the defined benefit scheme.

Example 1.1

Simone is a member of the Crows Superannuation Fund (a defined benefits scheme which secures her right to a retirement benefit of eight times her final average salary). Simone requests her employer to make contributions to the Bombers Superannuation Fund (an accumulation fund). However, she intends to remain a member of the Crows Superannuation Fund.

Without the provision included in subsection 32F(3), Simone’s employer would have to fund the eight times final average salary benefit, as well as an additional 9% SG contributions to the Bombers Superannuation Fund.

However, Simone’s employer will be required to contribute to the Bombers Superannuation Fund if she ceases to be a member of the Crows Superannuation Fund.

1.26 Subsection 32F(3) does not apply if the benefits the person is eligible for in the defined benefit scheme change as a result of choosing another fund. For example, the retirement benefit changes from being eight times final average salary to accrued benefits indexed to CPI or fund earnings.

1.27 From 1 July 2005, unless a contribution satisfies the choice of fund requirements in subsections 32C(3) to (9) inclusive [Schedule 1, item 22, section 32NA] employers will be required to provide a standard choice form in accordance with Division 6. Where an employer fails to comply with this Division, the employer will not meet their choice obligations by paying to an eligible choice fund [Schedule 1, item 22, subsection 32C(2)]. This will mean that the employer may face a penalty for not meeting their choice obligations.

1.28 Employers must give an employee a standard choice form:

• by 29 July 2005 to each employee employed by the employer on 1 July 2005 [Schedule 1, item 22, subsection 32N(1)];

• within 28 days of an employee first commencing employment after 1 July 2005 [Schedule 1, item 22, subsection 32N(2)]. However, an employer is not required to provide a standard choice form if the employee has chosen a fund within 28 days of commencing employment prior to receiving a standard choice form [Schedule 1, item 22, subsection 32NA(1)];

• within 28 days of the employee giving the employer a written request for a standard choice form. Note that an employer is not required to provide a standard choice form where an employee has been given a standard choice form within the previous 12 months [Schedule 1, item 22, subsection 32FA(2)]; or

• within 28 days of an employer becoming aware that they can no longer contribute to a chosen fund or the chosen fund ceases to be an eligible choice fund [Schedule 1, item 22, paragraphs 32N(4)(a) and (b)].

1.29 In addition to these requirements, an employer may also give a standard choice form at any time. [Schedule 1, item 22, subsection 32N(6)]

1.30 Further, the choice of fund requirements must be met separately by each employer of an employee. Therefore, a choice made by an employee under an offer made by one employer will not result in that fund being the chosen fund for that employee in respect of another employer. [Schedule 1, item 22, section 32X]

1.31 A standard choice form must be provided to an employee in writing and contain:

• a statement that the employee may choose any eligible choice fund for the employer as a chosen fund for the employee;

• the name of the fund to which the employer will contribute if the employee does not make a choice;

• information required by the regulations; and

• where the employee is a member of a defined benefits scheme and the employer is contributing to that scheme on behalf of the employee, information that is required under the regulations to be included.

[Schedule 1, item 22, paragraphs 32P(1)(a), (c), (e) and (g)]

1.32 An employer may refuse to accept an employee’s choice of fund if the employee chose another fund within the previous 12 months, or if the employee is unable to provide certain information such as the name of the fund and evidence that the chosen fund will accept the contributions from the employer on behalf of the employee. [Schedule 1, item 22, section 32FA]

1.33 A fund can only be a chosen fund if it is an eligible choice fund and it will accept contributions from the employer on behalf of the employee at the time that the choice is made. [Schedule 1, item 22, section 32G]

1.34 If the employee does not choose a fund then the employer can make contributions to any eligible choice fund. An eligible choice fund is a complying superannuation fund or RSA. Employers who are required to make award payments to a fund nominated in a Commonwealth industrial award will continue to make payments to that fund. The employer can choose any eligible choice fund if they are not required to make contributions to a fund nominated in a Commonwealth industrial award. This is consistent with the current application of the SGAA 1992.

1.35 Where an employer makes contributions under or in accordance with an AWA or a certified agreement, those contributions are made in compliance with the choice of fund requirements [Schedule 1, item 22, subsection 32C(2)]. The AWA must be made under the Workplace Relations Act 1996, and the certified agreement must be made under either the Workplace Relations Act 1996 or the Industrial Relations Act 1988.

1.36 The only collective agreements that will satisfy the choice of fund requirements are formal collective agreements via certified agreements.

1.37 There are a number of Victorian State individual and workplace agreements that were in force prior to the referral of Victoria’s industrial relations power to the Commonwealth. These agreements are now preserved under the Commonwealth’s Workplace Relations Act 1996, and are in essence no different to other workplace agreements made under that Act.

1.38 Contributions by an employer to a fund will satisfy the choice of fund requirements where that contribution is made under, or in accordance with, an employment agreement that was in force under the Employee Relations Act 1992 (Vic) and which continues by virtue of section 515 of the Workplace Relations Act 1996. [Schedule 1, item 22, subsection 32C(7)]

1.39 Contributions made by an employer in respect of employees where those contributions are made under, or in accordance with, a State industrial award are made in compliance with the choice of fund requirements. [Schedule 1, item 13, definition of ‘State industrial award’; and item 22, subsection 32C(8)]

1.40 The intention in respect of employees employed under State awards has always been that they would be exempt from the Commonwealth choice rules, irrespective of the level of superannuation support provided. For example, a contribution of 9% of an employee’s salary, paid to a State award fund, will satisfy the choice rules even though only 3% is required under the award.

1.41 In some cases an employer is obliged under law to make contributions for the benefit of an employee to a particular superannuation fund. In these cases, the employer’s contributions may be taken to be made in compliance with the choice of fund requirements because the fund to which the contributions are made is an unfunded public sector scheme [Schedule 1, item 22, paragraph 32C(1)(b)] or the contributions are made under, or in accordance with, a State industrial award [Schedule 1, item 22, subsection 32C(8)].

1.42 However, if the relevant scheme is not an unfunded public sector scheme and the contributions are not made under, or in accordance with, a State award, the employer faces the problem of having to satisfy both the choice of fund requirements and the terms of the relevant law. This could mean that the employer would need to contribute twice the minimum level of superannuation contributions in order to avoid any superannuation guarantee charge.

1.43 Regulations will be made which prescribe laws which cause this kind of difficulty for employers. Contributions made under a prescribed law will be taken to be made in compliance with the choice of fund requirements. The use of regulations allows a flexible approach under which each case where a law potentially causes difficulties may be considered on its merits, and be prescribed if appropriate. [Schedule 1, item 22, subsection 32C(9)]

1.44 Generally, where employers provide superannuation support on behalf of employees through unfunded public sector schemes, any contributions made (or notionally made) are in compliance with the choice of fund requirements. However, this rule does not apply in respect of Commonwealth employees who are members of the CSS or the PSS. [Schedule 1, item 15, definition of ‘unfunded public sector scheme’ in subsection 6(1); and item 22, paragraph 32C(1)(b)]

1.45 The minimum level of contributions required under the SGAA 1992 is calculated as a percentage of each employee’s notional earnings base. Generally, an employee’s notional earnings base will be one of the following figures:

• ordinary time earnings, which is basically the employee’s earnings for their ordinary hours of work;

• a measure of the employee’s earnings used in an applicable authority (this is defined under subsection 13(5) of the SGAA 1992 as an award, a law, an occupational superannuation agreement or a superannuation scheme) under which the employer’s superannuation obligation is determined. This earnings base is only available where the employer was contributing for an employee in accordance with the award, or under a like authority since before 21 August 1991; or

• if the employer provides superannuation support with an award, then the award earnings base.

1.46 Compliance with the choice of fund requirements could mean that an employer faces a higher notional earnings base in respect of an employee, and accordingly a higher cost in meeting their SG obligations. This would occur, for example, where an employer currently contributes on behalf of an employee under an award to a particular fund named in the award, but under choice is required to contribute for the employee to another fund that the employee chooses.

1.47 To prevent this occurring an employer is able to use an existing notional earnings base for an employee where it is reasonable to assume, if the choice of fund requirements did not apply, the employer would instead have contributed to another fund which gives rise to the existing notional earnings base. [Schedule 1, item 22, section 32Y]

1.48 For example, where an employer currently contributes for an employee to a particular fund in accordance with an award, it would be reasonable to assume the employer would have continued to contribute to that fund in the absence of the choice of fund requirements. It would also be reasonable to assume the employer would have contributed in accordance with the award for a new employee, where that employer would have been required to make contributions to a particular fund on behalf of that employee in accordance with the award.

1.49 The ‘other fund’ in respect of which it is reasonable to assume contributions would have been made, or support provided, if the choice of fund requirements did not apply, may be either a superannuation fund that is not a defined benefit scheme or a defined benefit scheme. The preserved notional earnings base are, however, only used where an employer is contributing on behalf of an employee to a superannuation fund that is not a defined benefit scheme, since it is only in these cases that the notional earnings base is directly used in reducing the SG charge percentage. The section only applies if the employer is contributing to a chosen fund or a default fund. It does not apply if contributions are made under a workplace agreement. [Schedule 1, item 22, subsections 32Y(1) to (4)]

1.50 This bill makes a requirement in a Federal award to make contributions on behalf of an employee to a particular superannuation fund unenforceable to the extent that the employer instead makes the contributions to another fund in compliance with the choice of fund requirements [Schedule 1, item 22, section 32Z]. Employers of employees covered by Federal awards are accordingly free to comply with the choice of fund requirements without facing action for non-compliance with an award (note that contributions made under, or in accordance with, State awards are effectively excluded from the choice of fund requirements – see paragraph 1.39)

1.51 The provision overrides Federal awards only to the extent a contribution is made to another fund that is a chosen fund. Accordingly, if an award requires contributions of 6% of salary to a particular fund, and contributions equivalent to 4% of salary are instead made to a chosen fund of the employee, the award remains enforceable in respect of the remaining 2% of salary payable as superannuation contributions.

1.52 Similarly, other conditions in awards relating to superannuation would not be affected (e.g. where the frequency of contributions is specified in the award this would not be affected). The provision is aimed only at allowing superannuation to be paid to a chosen fund rather than to a particular fund nominated in a Federal award, so that an employer does not face the possibility of the award being enforced in respect of an amount already paid to a chosen fund.

1.53 Employers are protected from liability to compensate any person for loss or damage arising from anything done by the employer in complying with the choice of fund requirements. [Schedule 1, item 22, section 32ZA]

1.54 The protection does not extend to things done by the employer which are not undertaken in complying with the choice of fund requirements.

1.55 The Commonwealth as an employer currently has overall responsibility for ensuring that individual departments and certain authorities meet their SG obligations. This bill contains amendments which have the effect of treating individual Commonwealth departments as separate employers [Schedule 1, items 1 to 5]. The provisions, as amended, will be similar to those in the Fringe Benefits (Application to the Commonwealth) Act 1986.

1.56 This means that individual departments and certain authorities will be responsible for satisfying their SG obligations, including the choice of fund requirements.

1.57 This bill applies penalty provisions for contraventions of the choice of fund requirements. [Schedule 1, items 15A to 15E]

1.58 Subsections 19(2A) and (2B) potentially give rise to an increase in the amount of an employer’s quarterly shortfall determined under subsection 19(1). Subsection 19(2A) applies when an employer makes contributions to an RSA or superannuation fund (other than a defined benefit scheme) which are not in compliance with the choice of fund requirements. Subsection 19(2B) applies where the contributions are paid to a defined benefit scheme. The ‘choice penalty’ will be paid to the employee.

1.59 Section 19A places a $500 cap on the amount of ‘choice penalty’ for an employee. Subsection 19A(1) places the cap on a particular quarter while subsection 19A(2) applies the cap for a notice period, which can consist of multiple quarters. For example an employer may be liable for a $300 shortfall in a quarter due to a breach of choice. The employer also breaches choice in the next quarter and is liable for an additional shortfall of $300. Under subsection 19A(2) the shortfall for the first quarter will be $300, and for the second quarter it will be the difference between the sum of any previous amounts and $500, being $200. In this case all subsequent quarters that the employer breaches choice will not accumulate a penalty, as the $500 cap has already been reached. [Schedule 1, item 15B, subsections 19A(2) and (3)]

1.60 This maximum limit does not reduce an employer’s liability to any quarterly shortfall as a result of failing to pay the required level of SG contributions for an employee.

1.61 A notice period will start upon commencement of choice, the day on which the employee is first employed by the employer, or once the preceding notice period has ended. A notice period will end once the Commissioner gives the employer written notice that the notice period has ended.

1.62 Once a new notice period has begun, an employer can accumulate shortfall liabilities to the maximum $500 cap, if the employer breaches choice again. [Schedule 1, item 15B, subsection 19A(4)]

1.63 The Commissioner will have the discretion to reduce (including to nil) any increase in an employer’s quarterly shortfall under new subsection 19(2E). The Commissioner is required to issue guidelines that the Commissioner must have regard to when deciding whether or not to reduce the increase in the quarterly shortfall. The guidelines must be made available for inspection on the internet. [Schedule 1, item 15E, section 21]

1.64 It should be noted that any increase in an employer’s quarterly shortfall will also lead to an increase in the nominal interest component under subsection 31(1) and potentially an increase in the administration component under section 32 of the SGAA 1992.

1.65 Where an employer makes a superannuation contribution in respect of an employee to an RSA or a superannuation fund other than a defined benefit scheme, and that contribution is not in compliance with the choice of fund requirements, subsection 19(2A) may apply to increase the employer’s quarterly shortfall. The amount of any increase is calculated in accordance with the following formula which is 25% of the shortfall that would apply if the contributions had not been paid.

![]()

1.66 As noted above, the maximum increase in the amount of an employer’s quarterly shortfall is $500.

1.67 The following examples outline the steps an employer will take in determining whether any increase in the quarterly shortfall arises.

1.68 Examples 1.2 to 1.6 assume the following information:

• Lucille is the only employee of Roger. Lucille has chosen a superannuation fund in compliance with the choice of fund requirements set out in Part 3A;

• Lucille’s salary is $36,000 (i.e. $9,000 per quarter) which is also her notional earnings base; and

• the SGC percentage for the year is 9%.

For simplicity, only the calculations for a particular quarter have been performed. All contributions are made to complying funds.

Example 1.2

Roger does not make any superannuation contributions for the quarter on behalf of Lucille.

Step one: determine quarterly shortfall for employee

Since the prescribed SG charge percentage has not been reduced by any amount, the charge percentage remains at 9% (i.e. 9% prescribed less 0% provided). The quarterly shortfall under subsection 19(1) in respect of Lucille is therefore $810 (i.e. 9% × $9,000).

Step two: determine any increase in quarterly shortfall

As Roger does not make any contributions in respect of Lucille, subsection 19(2A) does not apply.

Accordingly, Roger is not subject to any increase in the SGC.

Example 1.3

Roger makes a $810 superannuation contribution for the quarter on behalf of Lucille. The contribution is not made to the fund chosen by Lucille.

Step one: determine quarterly shortfall for employee

Since the contribution represents 9% of Lucille’s notional earnings base, the charge percentage is reduced to nil (i.e. 9% prescribed less 9% provided). The quarterly shortfall under subsection 19(1) in respect of Lucille is therefore $0.

Step two: determine any increase in quarterly shortfall

Since the contributions are not made in compliance with the choice of fund requirements, the quarterly shortfall under subsection 19(1) will be increased using the formula under subsection 19(2A) (see paragraph 1.65) up to a maximum increase of $500. Note that the quarterly shortfalls can be increased from nil under subsection 19(2D).

The amount of the increase in SGC is determined as follows:

The ‘notional quarterly shortfall’ is what the quarterly shortfall would be had Roger not made the contributions that did not comply with the choice of fund requirements (in this case, if Roger had not made any contributions), that is:

![]()

The amount worked out under subsection 19(1) is the amount calculated under step one, that is, $0.

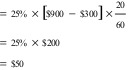

Using the formula in new subsection 19(2A), the increase in Roger’s quarterly shortfall is:

![]()

![]() Example 1.4

Example 1.4

Roger makes a $540 superannuation contribution for the quarter to Lucille’s chosen fund and $270 to another fund not chosen by Lucille.

Step one: determine quarterly shortfall for employee

The total contribution of $810 is 9% of Lucille’s notional earnings base. Therefore, the quarterly shortfall worked out under subsection 19(1) is $0.

Step two: determine any increase in quarterly shortfall

$270 of the contributions (3% of Lucille’s notional earnings base) do not comply with the choice of fund requirements. The quarterly shortfall under subsection 19(1) will be increased using the formula under subsection 19(2A):

The amount of the increase in the SGC is determined as follows:

The ‘notional quarterly shortfall’ is worked out on the basis that this contribution had not been made. If this were the case, the charge percentage would only be reduced to 3%. Therefore, the notional quarterly shortfall is:

![]()

The amount worked out under subsection 19(1) is $0.

Using the formula in new subsection 19(2A), the increase in Roger’s quarterly shortfall is:

![]()

Example 1.5

Roger makes a $810 superannuation contribution for the quarter to Lucille’s chosen fund and $270 to another fund not chosen by Lucille.

Step one: determine quarterly shortfall for employee

The total contribution of $1,080 is 12% of Lucille’s notional earnings base. Roger’s charge percentage is accordingly reduced to 0%. Therefore, the quarterly shortfall worked out under subsection 19(1) is $0.

Step two: determine any increase in quarterly shortfall

$270 of the contributions (3% of Lucille’s notional earnings base) do not comply with the choice of fund requirements. However, as Roger has met the required SG with contributions that satisfy the choice of fund requirements, there is no increase in the quarterly shortfall.

That is, using the formula under subsection 19(2A):

The ‘notional quarterly shortfall’ is worked out on the basis that the $270 contribution had not been made. If this were the case, Roger’s charge percentage would still be reduced to 0% as Roger has contributed the prescribed amount to Lucille’s chosen fund. Therefore, the notional quarterly shortfall is

![]()

The amount worked out under subsection 19(1) is $0.

Using the formula in subsection 19(2A), the increase in Roger’s quarterly shortfall is:

![]()

Example 1.6

Roger makes a $540 contribution to a fund not chosen by Lucille and makes no further contributions.

Step one: determine quarterly shortfall for employee

The contribution of $540 is 6% of Lucille’s notional earnings base. Therefore the quarterly shortfall worked out under subsection 19(1) is $270.

Step two: determine any increase in quarterly shortfall

$540 of the contributions (6% of Lucille’s notional earnings base) do not comply with the choice of fund requirements under subsection 19(2A). The quarterly shortfall under subsection 19(1) will be increased using the formula under subsection 19(2A).

The amount of the increase in the SGC is determined as follows:

The ‘notional quarterly shortfall’ is what the quarterly shortfall would be had Roger not made the contributions that did not comply with the choice of fund requirements in addition to any contributions he did not make at all. That is 9% of Lucille’s notional earnings base.

![]()

The amount worked out under subsection 19(1) is the amount calculated under step one, that is $270.

Using the formula in the new subsection 19(2A), the increase in Roger’s quarterly shortfall is:

![]()

1.69 Subject to section 20, subsection 19(2B) may apply where an employer provides superannuation support in respect of an employee through a defined benefit scheme. If an employer currently provides superannuation support on behalf of employees to a defined benefit scheme, there must be a benefit certificate (covering the whole or part of the contribution period) specifying a notional employer contribution rate for a class of employees in the scheme or schemes to which the employer is providing support, in order for the employer to meet his or her SG obligations.

1.70 Employers who use such schemes are still required to provide superannuation support in compliance with the choice of fund requirements. This is tested by reference to notional contributions to the defined benefit scheme. If on any day in the quarter the notional contributions to the scheme would not have been in accordance with the choice of fund requirements, the employer may be liable to extra SGC, calculated as:

![]()

![]()

![]()

1.71 Examples 1.7 and 1.8 assume the following information:

• Ben is an employee of IQ Pty Ltd (IQ) whose salary and wages for the quarter is $10,000;

• Ben is an employee for the whole of the quarter and the number of days in the quarter is 90 days;

• the SGC percentage for the year is 9%;

• IQ provides superannuation support for all of its employees through a defined benefit scheme. IQ has a benefit certificate specifying a notional employer contribution rate of 9% which has effect for the quarter;

• Ben is a member of the defined benefit scheme for the whole of the quarter (i.e. 90 days); and

• Ben chooses a different fund in compliance with the choice of fund requirements, which becomes Ben’s chosen fund 60 days into the quarter (i.e. there are 30 days which are in breach of the choice of fund requirements).

Example 1.7

Step one: determine quarterly shortfall for employee

Since IQ has a benefit certificate covering the whole of the quarter, the quarterly shortfall worked out under subsection 19(1) is $0.

Step two: determine any increase in quarterly shortfall

Since there is at least one day in the relevant period which is not in accordance with the choice of fund requirements (in actual fact, there are 30 days in breach of the choice of fund requirements), the quarterly shortfall under subsection 19(1) will be increased using the formula provided in paragraph 1.70.

The ‘notional quarterly shortfall’ is the amount that would have been worked out under subsection 19(1) if no reduction were made under subsection 22(2) in respect of the scheme. That is, the formula initially assumes that all of the notional contributions to the scheme are not in compliance with the employee’s choice of fund. In this case, the charge percentage would remain as 9%, giving a notional quarterly shortfall of $900.

The ‘number of breach of conditions days’ is 30 days.

The number of ‘relevant days in the quarter’ is 90 days (note, that in this case, the value of B in the formula in subsection 22(2) is 1, as the scheme membership period equals the employment period for the quarter).

A in the formula in subsection 22(2) is the notional employer contribution rate in relation to a class of employees. In these examples it is 9%.

Using the formula in new subsection 19(2B), the increase in IQ’s quarterly shortfall is:

Example 1.8

Assume the same information as in Example 1.7 except:

Ben commenced employment at the beginning of the quarter, and becomes a member of the defined benefit scheme after 30 days, (and this membership continues for the remainder of the quarter).

Ben has a chosen fund, in compliance with the choice of fund requirements, 70 days into the quarter (i.e. 20 days will be in breach of the choice of fund requirements).

Step one: determine quarterly shortfall for employee

In this case, IQ is not covered by the benefit certificate in respect of Ben for the first 30 days of the quarter and is covered for the remaining 60 days of the quarter. Under subsection 22(2), the employment period (i.e. 90 days in the quarter) is greater than the scheme membership period (i.e. 60 days), which means the reduction in the charge percentage is:

![]()

Therefore, IQ’s quarterly shortfall worked out under subsection 19(1), is 3% (i.e. 9% – 6%) multiplied by Ben’s quarterly salary and wages ($10,000), which equals $300.

Step two: determine any increase in quarterly shortfall

Since there is at least one day in the quarter which is not in accordance with the choice of fund requirements (actually there are 20 days in breach in this case), the quarterly shortfall under subsection 19(1) will be increased using the formula provided in paragraph 1.70.

The ‘notional quarterly shortfall’ in this example is $900 (for the same reasons given in Example 1.6, that is, assuming all of the notional contributions to the scheme are not in compliance with the employee’s choice of fund. Therefore, the charge percentage would remain as 9%, giving a notional quarterly shortfall of $900).

The ‘number of breach of conditions days’ is 20 days.

The number of ‘relevant days in the quarter’ is 60 days (note, that in this case, the value of B in the formula in subsection 22(2) is 0.333).

Using the formula in new subsection 19(2B), the increase in IQ’s quarterly shortfall is:

1.72 Section 19(2B) will not apply to increase the quarterly shortfall of an employer, in respect of an employee and a scheme, where subsection 20 is satisfied [Schedule 1, item 15A, paragraph 19(2B)(c); and item 25, section 20]. There are two circumstances in which section 20 will apply. These are:

• in respect of existing employees, where a defined benefit scheme is in surplus (see paragraphs 1.75 to 1.81); and

• where a defined benefit member of a defined benefit superannuation scheme has achieved their ‘maximum benefit accrual’ (see paragraphs 1.82 and 1.83).

1.73 Item 10 inserts a definition of ‘defined benefit superannuation scheme’ into the SGAA 1992.

1.74 Item 9 inserts a definition of ‘defined benefit member’ into section 6 of the SGAA 1992. A defined benefit member is a person whose superannuation benefit is defined by reference to either of the following:

• the amount of the person’s salary at retirement, at an earlier date or the person’s salary as averaged over a period before retirement. An example of the average system is where the salary is taken to be the highest average salary for a year over the last three years before retirement; or

• a specified amount.

1.75 Where an employee of an employer is a member of a defined benefit scheme the application of the SG law is determined by reference to a benefit certificate provided by an actuary in respect of the scheme. Whether an employer is required to in fact make contributions to the scheme during a period will depend on the solvency of the scheme. The solvency of a scheme is also determined by an actuary. Where the scheme is in surplus (that is, broadly, that the assets of the scheme exceeds its liabilities) and the employer is not required to make contributions for a period, the employer is said to be enjoying a ‘contributions holiday’.

1.76 A defined benefit scheme may have a surplus because, for example, additional superannuation contributions have been made by the employer or through the achievement of higher than expected investment returns.

1.77 A defined benefit scheme will be considered to be in surplus, for the purpose of effectively exempting an employer from the choice of fund requirements for a quarter, where the following conditions apply:

• an actuary has provided a certificate stating that the employer is not required to make contributions for the quarter; and

• an actuary has provided a certificate stating that at all times from 1 July 2005 until the end of the quarter that the assets of the scheme are, and will be equal to or greater than 110% of the greater of the scheme’s liability in respect of vested benefits and the scheme’s accrued liability. This certificate is to be updated at least every 15 months. [Schedule 1, item 15D, subsection 20(2)]

1.78 The term ‘scheme’s liability in respect of vested benefits’ is defined to mean the value, at a particular time, of benefits payable from the scheme if all the members entitled to those benefits terminated their employment with the employer at that time. The term ‘scheme’s accrued actuarial liabilities’ is defined to mean the total value, at a particular time, of the future benefit entitlements of members in respect of their membership up to that time. The calculation of the ‘scheme’s accrued actuarial liabilities’ is to be performed by an actuary. [Schedule 1, item 15D, subsection 20(4)]

1.79 The requirement that an actuary certify that the scheme’s assets are equal to or greater than 110% of the greater of the ‘scheme’s liabilities in respect of vested benefits’ and the ‘scheme’s accrued actuarial liabilities’ is designed to provide a buffer against short term decreases in the value of the assets backing the vested benefits and to ensure that the scheme is truly in surplus.

1.80 The effective exemption from the choice of fund provisions operates in respect of employees who are members of a defined benefit scheme immediately before 1 July 2005 and who continue that membership. [Schedule 1, item 15D, paragraphs 20(2)(a) and (b)].

1.81 Where a scheme is in surplus for all quarters after 1 July 2005 the employer remains exempt from the choice of fund provisions until the scheme’s surplus is extinguished. Where the surplus ceases to exist the employer will have to offer choice to its employees.

1.82 Where a defined benefit scheme has defined benefit members who have reached their maximum benefit accrual, employers of those members are effectively exempt from making further superannuation contributions for those employees, for the period a benefit certificate (see section 10 of the SGAA 1992) remains in effect for the scheme. In these circumstances the employer will be exempt from the proposed choice of fund legislation in relation to those employees.

1.83 An employee will be considered to have reached his or her maximum benefit accrual if after the start of the quarter the defined benefit that has accrued to the employee will not increase except as a result of the following changes:

• an increase in the employee’s remuneration (e.g. a pay rise);

• increases in the employee’s benefit due to investment earnings of the fund;

• increases in the benefit by virtue of indexation;

• any other way that is prescribed.

[Schedule 1, item 15D, subsection 20(3)]

1.84 Contributions made from 1 July 2005 must be made in accordance with the choice of fund requirements set out in Part 3A.

1.85 If a contribution is made after the employee ceased employment but is nevertheless made in respect of the employment, the contribution is taken to be made immediately before the employee ceased employment. [Schedule 1, item 22, subsection 32C(10)]

1.86 A consequential amendment to the RSA Act will ensure that choice of fund operates as intended. [Schedule 1, item 1A]

1.87 Division 3 of Part 5 of the RSA Act contains section 52. Section 52 requires employers to provide employees with a choice of alternative superannuation vehicles before making an application for an RSA on behalf of the employee.

1.88 The effect of the choice of fund amendments made by Schedule 1 to the bill will mean that section 52 is no longer necessary.

Chapter

2

Regulation impact

statement

2.1 The policy objective of the choice of fund proposal is to provide employees with greater choice as to which complying superannuation fund or RSA will receive compulsory superannuation contributions made on their behalf by the employer. Greater competition and better returns will benefit all persons with superannuation and will reduce, over time, pressure on the age pension system.

2.2 This measure is expected to increase competition, efficiency and performance within the superannuation industry and result in reductions in fees and charges for persons with superannuation.

2.3 This proposal was first announced in the 1997-1998 Federal Budget. Previous legislation to implement the proposal was defeated in the Senate on 8 August 2001. Details of the measure were given in Minister for Revenue and Assistant Treasurer’s Press Release No. C42/02 of 14 May 2002. Revised details of the measure were announced by Minister for Revenue and Assistant Treasurer’s Press Releases C40/03 of 25 May 2003 and C94/03 of 9 October 2003.

2.4 The choice of fund regime would mean:

• an employee would be able to choose any complying superannuation fund or RSA into which their employer superannuation contributions would be deposited;

• that where employer contributions are being made to a defined benefit fund, the employer would need to advise an employee of the consequences of a choice that would reduce contributions or other specific entitlements (e.g. death and disability insurance);

• an employee can make a choice at any time provided that they have not chosen a fund within the previous 12 months;

• after making their initial choice, all employees will be able to make a further choice at least every 12 months thereafter;

• an employer will contribute to any eligible choice fund if they are not required to make contributions to a fund nominated in a Commonwealth award, when an employee does not choose a fund;

• an employer can refuse to accept an employee’s chosen fund if the employee fails to provide the employer with certain information such as the name of the fund and evidence that the fund will accept contributions from the employer on behalf of the employee;

• employers may face a taxation penalty if they fail to comply with the choice of fund requirements; and

• in line with workplace relations reforms, choice would be subject to the terms of workplace agreements which provide employees with a choice of superannuation fund for their employer contributions.

2.5 Groups affected by the measure will familiarise themselves with the changes using assistance provided by the ATO and ASIC.

2.6 The ATO will provide employers and employees with information in a number of forms. In particular, the ATO will provide information through:

• new pamphlets directed specifically at an impact group (e.g. employers or employees), which sets out the information in a ‘question and answer’ style;

• the ATO’s existing Internet facilities; and

• the ATO’s existing telephone help lines.

2.7 The private sector may also contribute to the education of affected groups.

2.8 The following groups will be impacted:

• employers (approximately 0.654 million will be affected);

• employees (approximately 4.819 million will be affected);

• superannuation funds and RSA providers;

• professional advisers (e.g. investment and tax advisers);

• the ATO;

• the APRA; and

• the ASIC.

2.9 Both employers and employees may incur some cost if they choose to negotiate a workplace agreement. This is only likely to be significant where the primary purpose of that agreement is to provide employees with a choice of superannuation fund. Costs will be marginal where the provision of a choice of superannuation fund is part of a general workplace agreement.

2.10 The affected groups will incur the following compliance and administrative costs.

2.11 All impact groups will need to familiarise themselves with the change. The ATO and ASIC will need to devote additional resources in providing information support to the other impact groups.

2.12 Larger employers will need to update their technology in order to satisfy their obligations. Employers will not be able to vet the decision of the employee and will therefore be contributing to a greater number of funds of RSAs.

2.13 Fund/RSA providers will need to update their technology, as they may be receiving contributions from a wider range of employers.

2.14 Employees will incur costs in choosing a fund as they may need to seek information from alternative funds.

2.15 Employers will also need to provide employees with a PDS for the fund or RSA in to which the employer contributes when the employee does not choose a fund.

2.16 Employers will be required to make contributions to a greater number of funds and RSAs than at present. Larger employers will have a greater relative capacity to absorb these additional costs, particularly those employers who contribute to funds by electronic means. On the other hand, contributions will be made to more funds and RSAs where an employer has a large number of employees.

2.17 Employers will be required to provide additional information to employees where that employer’s contributions are currently being made to a defined benefit fund. Employers will be required to provide prescribed information to these employees including the consequences of a choice that would reduce contributions or other specific entitlements (e.g. death and disability insurance). Data from APRA states that there are 575 defined benefit funds with 482,000 members. There are an additional 592 hybrid funds of which at least one member in each fund is a defined benefit member. Anecdotal evidence suggest that many of these funds are closed to new members. Therefore, it is expected that this requirement will only affect a minority of employers.

2.18 There will also be additional record keeping requirements. Employers will need to keep track of what choices were made, and when they were made. These costs will rise according to the number of employees, and will therefore be higher for larger employers.

2.19 Reporting and remitting obligations imposed on employers will result in a complementary increase in workflows for the ATO.

2.20 Total compliance costs (costs incurred by employers, employees and fund/RSA providers) are set out in Table 2.1.

Table 2.1

|

Impact group

|

Initial costs

|

Recurrent costs

|

|

Employers

|

$27 million

|

$18 million

|

|

Employees

|

n/a

|

n/a

|

|

Fund/RSA providers

|

$7 million

|

$2 million

|

2.21 In calculating the cost of compliance the following assumptions have been used:

• 654,000 employers will be subject to choice; 500,000 of which will not be covered by workplace agreements;

• the cost to comply for an employer will be $18/hour after tax;

• initially it will take three hours to comply and two hours thereafter;

• the costs for employees are not available due to difficulties in predicting how they will react to the measure;

• the cost to comply for a fund/RSA will be $18/hour after tax; and

• initially it will take three hours to comply and one hour thereafter.

2.22 The costs of implementing and administering this measure (including the education campaign) are set out in Table 2.2.

Table 2.2

|

2004-2005

|

2005-2006

|

2006-2007

|

2007-2008

|

Total

|

|

$12.6 million

|

$10.3 million

|

$3.4 million

|

$2.3 million

|

$28.6 million

|

2.23 The Government has engaged in consultation with a wide range of interested parties on the choice of funds proposal, including the superannuation industry (in particular, the Association of Superannuation Funds of Australia and the Investment and Financial Services Association), employer groups (in particular the Australian Chamber of Commerce and Industry), small business groups (in particular the Council of Small Business of Australia) and those representing employee interests. As a result of those consultations, a number of enhancements to the original 1997-1998 Federal Budget announcement were made, particularly by reducing the burden of choice on employers while ensuring the key objective of greater choice of fund is preserved.

2.24 Providing choice of fund will necessarily increase costs for some employers. The Government believes the benefits of choice to employees and the community more generally, outweigh these costs.

|

Bill reference

|

Paragraph number

|

|---|---|

|

Item 1A

|

1.9, 1.86

|

|

Items 1 to 5

|

1.55

|

|

Item 6, definition of ‘Commonwealth employee’ in subsection

6(1)

|

1.14

|

|

Item 8, definition of ‘CSS’ in subsection 6(1)

|

1.14

|

|

Item 12, definition of ‘PSS’ in subsection 6(1)

|

1.14

|

|

Item 13, definition of ‘State industrial award’

|

1.39

|

|

Item 13, definition of ‘State industrial award’ in subsection

6(1)

|

1.14

|

|

Item 15, definition of ‘unfunded public sector scheme’ in

subsection 6(1)

|

1.44

|

|

Items 15A to 15E

|

1.57

|

|

Item 15A, paragraph 19(2B)(c)

|

1.72

|

|

Item 15B, subsections 19A(2) and (3)

|

1.59

|

|

Item 15B, subsection 19A(4)

|

1.62

|

|

Item 15E, section 21

|

1.63

|

|

Item 15D, subsection 20(2)

|

1.77

|

|

Item 15D, paragraphs 20(2)(a) and (b)

|

1.80

|

|

Item 15D, subsection 20(3)

|

1.83

|

|

Item 15D, subsection 20(4)

|

1.78

|

|

Item 22, section 32C

|

1.12

|

|

Item 22, paragraph 32C(1)(a)

|

1.14

|

|

Item 22, paragraph 32C(1)(b)

|

1.14, 1.41, 1.44

|

|

Item 22, subsection 32C(2)

|

1.27, 1.35

|

|

Item 22, subsections 32C(2) and (2A)

|

1.14

|

|

Item 22, subsections 32C(3) to (5)

|

1.14

|

|

Item 22, subsection 32C(6)

|

1.7, 1.14

|

|

Item 22, subsection 32C(7)

|

1.14, 1.38

|

|

Item 22, subsection 32C(8)

|

1.14, 1.39, 1.41

|

|

Item 22, subsection 32C(9)

|

1.14, 1.43

|

|

Item 22, subsection 32C(10)

|

1.85

|

|

Item 22, section 32D

|

1.22

|

|

Item 22, section 32E

|

1.10

|

|

Item 22, subsection 32E(2)

|

1.10

|

|

Item 22, subsections 32F(1) and (2)

|

1.18

|

|

Item 22, subsection 32F(3)

|

1.23

|

|

Item 22, section 32FA

|

1.32

|

|

Item 22, subsection 32FA(1)

|

1.19

|

|

Item 22, subsection 32FA(2)

|

1.19, 1.28

|

|

Item 22, section 32G

|

1.21, 1.33

|

|

Item 22, subsections 32N(1) and (2)

|

1.28

|

|

Item 22, paragraphs 32N(4)(a) and (b)

|

1.28

|

|

Item 22, subsection 32N(6)

|

1.29

|

|

Item 22, section 32NA

|

1.27

|

|

Item 22, subsection 32NA(1)

|

1.28

|

|

Item 22, paragraphs 32P(1)(a), (c), (e) and (g)

|

1.31

|

|

Item 22, section 32X

|

1.30

|

|

Item 22, section 32Y

|

1.47

|

|

Item 22, subsections 32Y(1) to (4)

|

1.49

|

|

Item 22, section 32Z

|

1.50

|

|

Item 22, section 32ZA

|

1.53

|

|

Item 25, section 20

|

1.72

|